Res Judicata Applies to SEBI Proceedings: Supreme Court

- Lawttorney.ai

- Apr 10, 2025

- 4 min read

Case Title: Sebi Versus Ram Kishori Gupta & Another

Context: The Court applied the doctrine of constructive res judicata, as explained in Explanation IV to Section 11 of the Civil Procedure Code (CPC). It held that SEBI could not order disgorgement in a later decision when it had already had the chance to do so during earlier proceedings.

A Bench of Justices Sanjay Kumar and K.V. Viswanathan looked into whether the principle of res judicata applies to cases under the SEBI Act, 1992 especially when SEBI tries to pass more than one final order based on the same facts.

The Court observed that SEBI had issued show-cause notices in 2012 and later passed a final order on July 31, 2014, under Section 11B of the SEBI Act. That order was fully implemented and had reached finality. Therefore, SEBI was not allowed to reopen the same matter and issue a fresh order under the same provision four years later without any valid reason.

Case Background:

M/s. Vital Communications Limited (VCL), based in New Delhi, was a publicly listed company with its shares traded on the Bombay Stock Exchange, the Delhi Stock Exchange, and the National Stock Exchange. The notice related to allegations of misleading advertisements concerning a buyback of shares, issuance of bonus shares, and a preferential allotment, all within a 30-day period.

It was alleged that VCL had published advertisements in newspapers that misled investors by quoting the share price as ₹30, while in reality, the shares were trading between ₹3 and ₹12. Eventually, SEBI dropped the charges against the former Chairman and Managing Director of VCL. A reduced penalty was imposed on one of the directors, which included a six-month ban from accessing the securities market, along with a restriction on buying, selling, or dealing in securities.

As for the remaining noticees including VCL, its directors, and promoters SEBI imposed a two-year ban on their access to the securities market, along with a prohibition on any dealings in securities during that period. In response, VCL filed an appeal with the Securities Appellate Tribunal (SAT) in Mumbai. SAT allowed the appeal and sent the case back to SEBI for reconsideration. Meanwhile, a couple who claimed to have invested in VCL shares based on the misleading advertisements also approached SAT in a separate appeal. However, SAT held that under Section 11(2) of the SEBI Act, SEBI did not have the authority to grant compensation to investors for losses caused by false or misleading advertisements.

Following this decision, SEBI issued fresh show-cause notices to VCL and related parties. Following this, SAT mandated that SEBI ensure the affected investors receive their compensation within a specified period. SEBI, in turn, challenged SAT’s direction before the Supreme Court.

Supreme Court’s Observation on Res Judicata

The Supreme Court has dismissed SEBI's argument that the doctrine of res judicata, as outlined in Section 11 of the Code of Civil Procedure, is inapplicable to its proceedings. The Court clarified that this doctrine, which is rooted in principles of public policy and justice, serves to prevent the repeated litigation of identical issues by the same parties.

In its ruling, the Court referenced previous cases that establish the applicability of res judicata not only to the parties involved in litigation but also to various adjudicating bodies, including those that are judicial, quasi-judicial, or administrative. It underscored that SEBI's order from 2014, which merely imposed a market ban, had become final, thereby precluding SEBI from later imposing a disgorgement order based on the same circumstances.

The Court pointed out that SEBI had ample opportunity in 2014 to mandate disgorgement but opted not to pursue that course of action. The issuance of a new order in 2018 was characterized as an afterthought. While acknowledging the financial repercussions of the illegal activities conducted by VCL and other entities, the Court maintained that SEBI's earlier decision to impose lesser penalties indicated its satisfaction with the outcome. Consequently, without valid justification, SEBI cannot revisit that conclusive order to issue new directives, as doing so would contravene public policy, which values the finality of judicial decisions and the principle of res judicata.

Conclusion

The Supreme Court made it clear that once SEBI’s 2014 order became final, it could not reopen the case and issue a new order on the same facts. The Court stressed that legal decisions must have finality, and SEBI cannot go back and change its stance without strong reasons. This ensures fairness and prevents repeated litigation on the same issue.

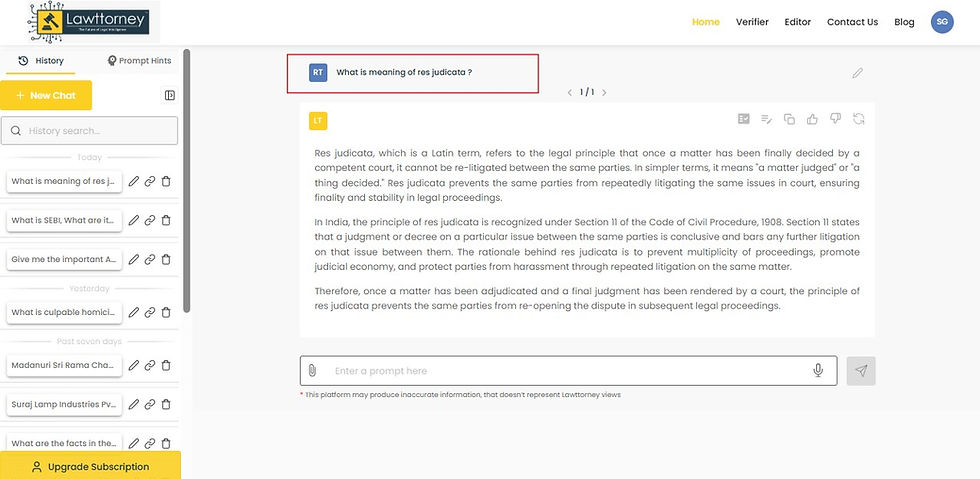

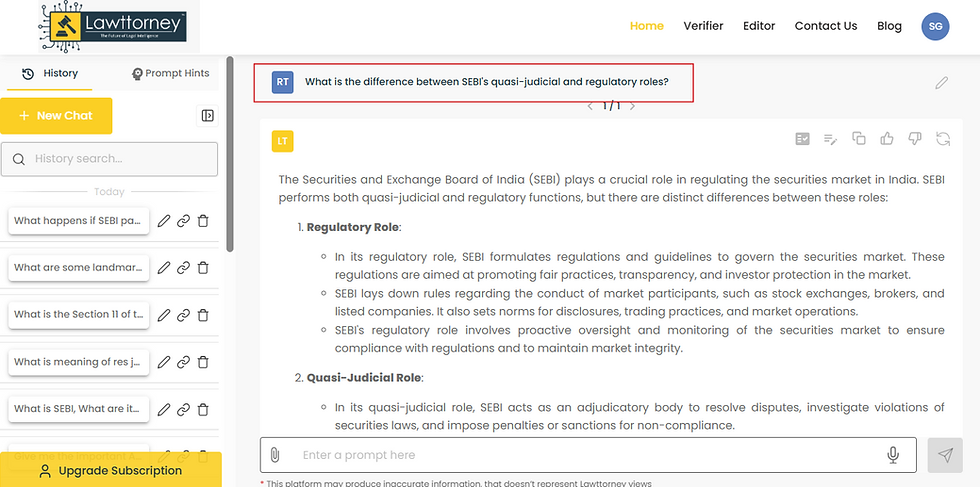

⚖️ Enhance Legal Precision with AI-Powered Insights

Are you navigating complex legal challenges like Res Judicata or SEBI proceedings? Stay ahead with Lawttorney.AI—your intelligent legal companion. Streamline research, improve decision-making, and stay compliant.

👉 Join our free webinar today and experience the future of legal tech in action!

Comments