Supreme Court Restores FIR Against Company Director, Emphasizes Scrutiny in Economic Offences.

- Lawttorney.ai

- May 6, 2025

- 5 min read

Updated: May 14, 2025

Context

India’s rapid economic expansion over years has, alongside its many benefits, exposed the country’s financial and legal systems to a range of complex corporate malpractices. Ranging from shell companies and accounting frauds to willful defaults and layered money transfers, white-collar crime has grown both in scale and subtlety. Thus, the role of the courts is to protect the integrity of the financial system overall as well as to enforce contractual obligations.

Amidst this changing legal and economic environment, the Supreme Court recently issued a significant judgment in the case of Dinesh Sharma Versus Emgee Cables And Communication Limited And Another setting aside a Rajasthan High Court order that had quashed an FIR in what initially appeared to be a civil dispute between two companies. The apex court's ruling underlines a critical point: when the mechanics of a transaction indicate deceit, camouflage, and deliberate financial misdirection, it may no longer be a matter of civil breach rather it may well be a criminal offence.

Factual Background of the Case

The case emerged from a dispute between two companies, M/s BLS Polymers Ltd., represented by Dinesh Sharma, and Emgee Cables and Communication Ltd. The parties had a history of commercial dealings. According to Sharma, Emgee Cables had procured electrical goods worth crores on credit. As per routine business practice, payments were expected to follow. Post-dated cheques were issued but when they were deposited, they bounced.

Despite repeated reminders, no payment was made. What escalated the situation was Sharma’s visit to Emgee Cables' office, only to find it completely shut. There was no official communication of business closure, no legal notice, and no offer to resolve the matter. This prompted Sharma to dig deeper. He alleged that the directors of Emgee Cables had set up a network of shell companies to siphon funds and avoid liability. These weren't mere delays in payment; they were part of a calculated effort to defraud.

An FIR was registered against the company’s directors under Sections 420 (cheating), 406 (criminal breach of trust), and 120B (criminal conspiracy) of the Indian Penal Code (IPC), 1860. However, following the enactment of the Bharatiya Nyaya Sanhita (BNS), 2023, these sections have been replaced. Specifically, Section 420 of the IPC is now covered under Section 318(4) of the BNS, 2023 for cheating, Section 406 is replaced by Section 316(2) for criminal breach of trust, and Section 120B is now Section 61(2) for criminal conspiracy under the BNS, 2023. On a plea by the accused directors, the Rajasthan High Court dismissed the FIR stating that there was not enough criminal intent to support prosecution because the case was based on a business transaction. The High Court saw the use of criminal law as a kind of coercion and essentially saw the disagreement as one that should be resolved civilly.

This order was challenged in the Supreme Court.

Supreme Court’s Observations

A significantly different stance was adopted by the Supreme Court bench, which included Justices Bela M. Trivedi and Prasanna B. Varale. While courts must exercise caution when permitting criminal law to become involved in business disputes, Justice Varale noted in his ruling that the facts of this case involved more than just a breach of a corporate agreement.

The Court pointed out that the High Court had overstepped its jurisdiction by quashing the FIR at such a preliminary stage, especially when allegations indicated something far deeper than a commercial fallout. The complaint included credible claims that shell companies had been used to reroute funds, evade payment, and escape accountability. This, the Court said, was not a mere failure to pay; it suggested a potentially orchestrated financial fraud and economic offence.

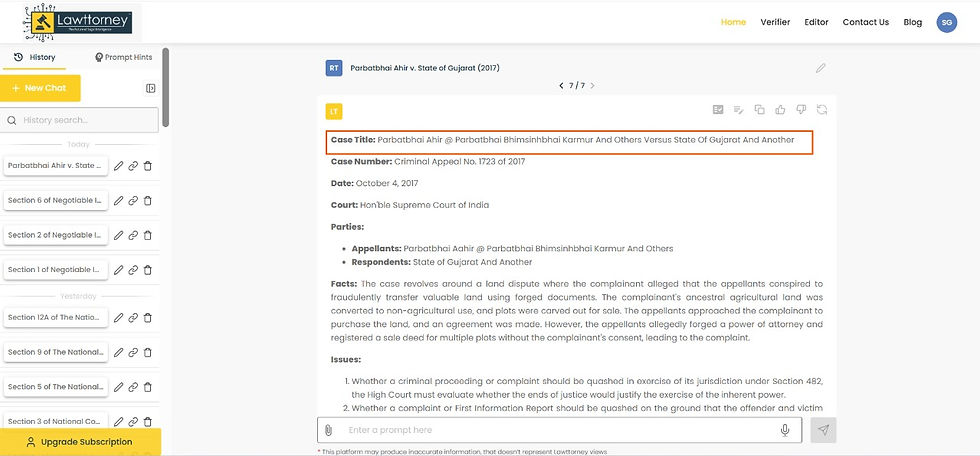

The judgment also referred to the precedent in Kurukshetra University v. State of Haryana (1977), which emphasized that the inherent powers of the High Court under Section 482 of the CrPC must be exercised sparingly, and only in exceptional cases where the allegations are absurd or implausible on their face. Similarly, in Parbatbhai Ahir v. State of Gujarat (2017), the Court had previously held that economic offences occupy a distinct category and cannot be lightly dismissed, as they involve systemic consequences that go beyond private parties.

The bench noted that when even a prima facie case suggests financial conspiracy, courts must allow the investigation to run its course, rather than rushing to shut it down.

Supreme Court’s Ruling

Setting aside the High Court’s decision, the Supreme Court reinstated the FIR against the directors of Emgee Cables and Communication Ltd. It observed that the evidence presented at the FIR stage was sufficient to warrant an investigation, and that quashing it would amount to short-circuiting due process.

The Court also considered the identical contention that one of the directors had resigned prior to the impugned transactions. Examining this claim, the Court observed that after the alleged resignation, the director had persisted in signing purchase orders and other business correspondence, indicating continued participation in the operations of the company.

While reaffirming that its comments were only preliminary observations, the Supreme Court made it clear that the trial court must now allow the case to proceed based on the evidence gathered during investigation. The trial, the Court said, must be conducted on its own merits, uninfluenced by its judgment.

Conclusion

This decision is a warning to the courts and corporate entities alike. It reiterates that not all business defaults are civil cases and that courts must exercise caution when granting hasty asylum to potentially guilty parties in the name of preserving business ties.

The Supreme Court’s judgment reflects a deeper concern about the growing sophistication of economic offences, where deception is masked by documentation, and fraud is dressed up as failed business. It reinforces the principle that a financial transaction can transform into a criminal conspiracy when accompanied by intent to cheat, especially when supported by circumstantial evidence like the use of shell companies and false promises of payment.

As India's financial infrastructure grows and attracts more domestic and foreign investment, the judiciary must ensure that these transactions remain trustworthy and transparent. Eliminating a formal complaint at the threshold will convey the wrong message, particularly in cases where there are substantial allegations of conspiracy and evidence of intentional financial malfeasance.

Economic violations are subject to rigorous judicial assessment, and any attempt to dismiss them too quickly would not be accepted, the Supreme Court has made plain. In addition to resolving disputes, the legal system must maintain trust.

Case Title: Dinesh Sharma Versus Emgee Cables And Communication Limited And Another

Empower Your Legal Practice with AI

Are you a legal professional? Stay ahead with our innovative Lawttorney.AI tool. Streamline your legal processes, enhance productivity, and gain a competitive edge. Experience the future of legal technology—try our free Webinar session today!

Comments